Back

5 Mar 2020

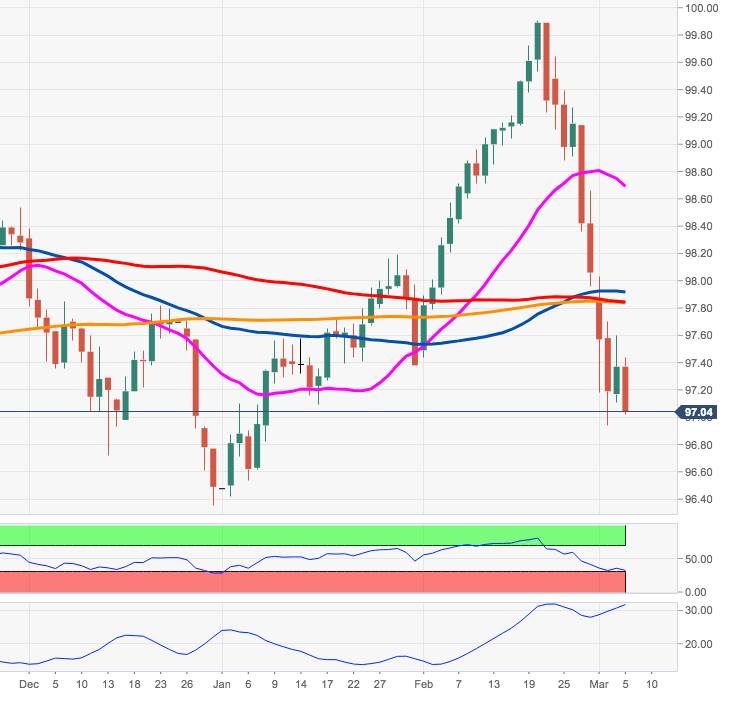

US Dollar Index Price Analysis: Rising odds for a test of 96.36

- DXY resumes the downside on Thursday and challenges 97.00.

- While the 200-day SMA at 97.81 caps the upside, further losses are likely.

DXY has faded Wednesday’s uptick and it has now refocused on the downside.

After breaking below some interim supports at Fibo retracements and the key 200-day SMA, the index has now opened the door to a deeper decline.

That said, a move to the December 2019 low at 96.36 should not be ruled out, particularly against mounting speculations that the Fed could move on rates once again at the March 17-18 meeting.

DXY daily chart