AUD/JPY Price Analysis: Multiple upside barriers keep bears hopeful

- AUD/JPY remains on the recovery mode.

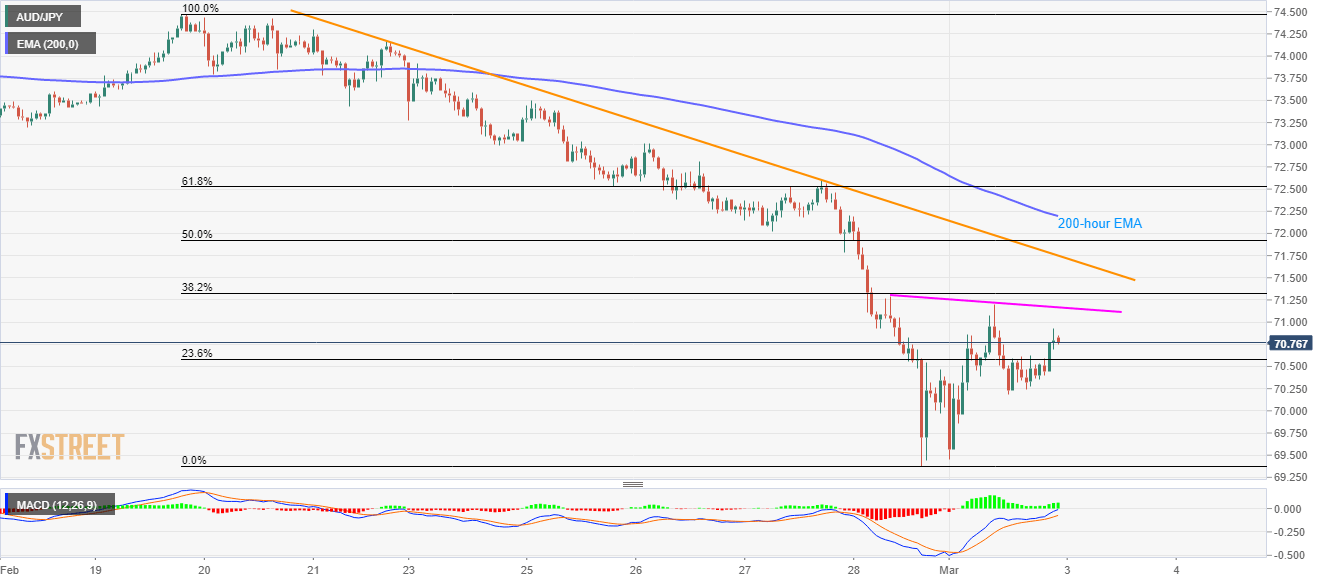

- Multiple short-term trend line, 200-hour EMA and the key Fibonacci retracements keep the buyers in check.

- The bears will look for entry below a descending trend line from early-January 2019.

AUD/JPY holds onto Monday’s recovery gains while taking the bids to 70.83 during the early Tuesday morning in Asia. Even so, multiple strong resistances challenge the pair’s latest pullback.

Among them, a two-day-old falling trend line near 71.20 acts as the immediate resistance followed by another resistance line stretched from February 21, at 71.75 now.

During the quote’s further upside beyond 71.75, a 200-hour EMA level of 72.20 as well as 61.8% Fibonacci retracement of the late-February drop, at 72.53, will be important to watch.

Meanwhile, 70.20, 70.00 and Friday’s low near 69.40 can entertain short-term sellers during the fresh declines.

However, the major downside will wait for the pair’s sustained weakness below a descending trend line connecting lows marked from January 2019, at 69.30.

AUD/JPY hourly chart

Trend: Bearish