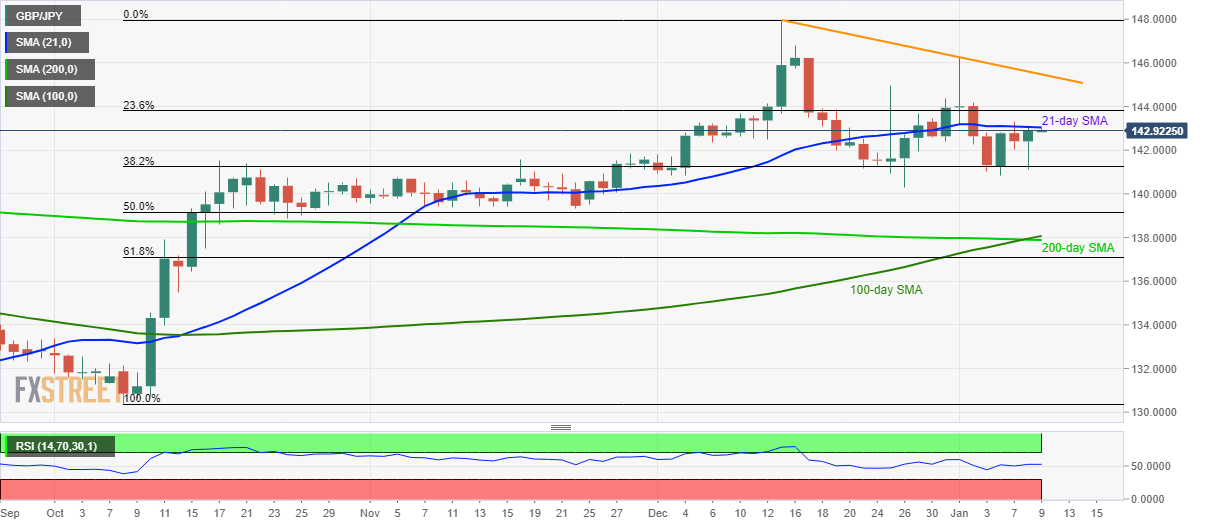

GBP/JPY Technical Analysis: 21-day SMA restricts immediate upside

- GBP/JPY is mildly positive below the near-term key resistance.

- The pair stays above 38.2% Fibonacci retracement since early December.

- 100/200-day SMA confluence offers strong support.

GBP/JPY holds onto recovery gains while taking the bids to 142.92 during early Thursday morning in Asia. The pair has been capped below 21-day SMA off-late but stays above 38.2% Fibonacci retracement of October-December since December 04.

As a result, buyers look for entry beyond a 21-day SMA level of 143.00 to question 23.6% Fibonacci retracement at 143.82.

However, pair’s further upside will be questioned by a short-term descending trend line, near 145.50, which if broken can propel GBP/JPY prices to 148.00.

On the contrary, pair’s declines below 38.2% Fibonacci retracement of 141.25 can drag the quote to 140.00 and then to 50% Fibonacci retracement, at 139.17.

It should, however, be noted that the confluence of 100 and 200-day SMA around 137.90/138.10 could restrict the pair’s additional south-run below 139.17.

GBP/JPY daily chart

Trend: Pullback expected