Gold price hits new record high near $3,090 as Fed cut bets defy trade war fears

- Gold surges to fresh all-time high as safe-haven demand rises ahead of Trump’s auto tariff deadline.

- Despite core PCE uptick, Fed’s Daly sees two cuts in 2025; market now pricing in 73.5 bps of easing.

- DXY weakens, US yields slide, and global tensions mount as Canada and EU prep retaliation plans.

Gold price rallied sharply on Friday, hitting a new record high of $3,086 amid uncertainty over US trade policy, alongside an uptick in the Federal Reserve's (Fed) preferred inflation gauge. After this, traders seem confident that the Fed will cut rates twice in 2025. The XAU/USD trades at 3079, up 0.79%.

The market mood is pessimistic as traders brace for April 2, the so-called “Liberation Day” by US President Donald Trump, who signed an executive order applying 25% tariffs on all cars imported to the US. This triggered reactions worldwide, primarily in Canada and the European Union (EU), which has begun preparing to retaliate against this measure.

In the meantime, the Greenback remains battered and is set to finish the week with losses of 0.11%, according to the US Dollar Index (DXY), which underpins the prices of precious metals. US yields are also dropping as investors seeking safety piled into Bullion and the Japanese Yen (JPY).

The US economic calendar revealed that the Core Personal Consumption Expenditures (PCE) Price Index in February was mostly aligned with forecasts, while the University of Michigan Consumer Sentiment survey in March deteriorated further.

Aside from this, San Francisco Fed Mary Daly stated that she foresees two rate cuts in 2025, adding recently that she is focused 100% on inflation due to progress being flat.

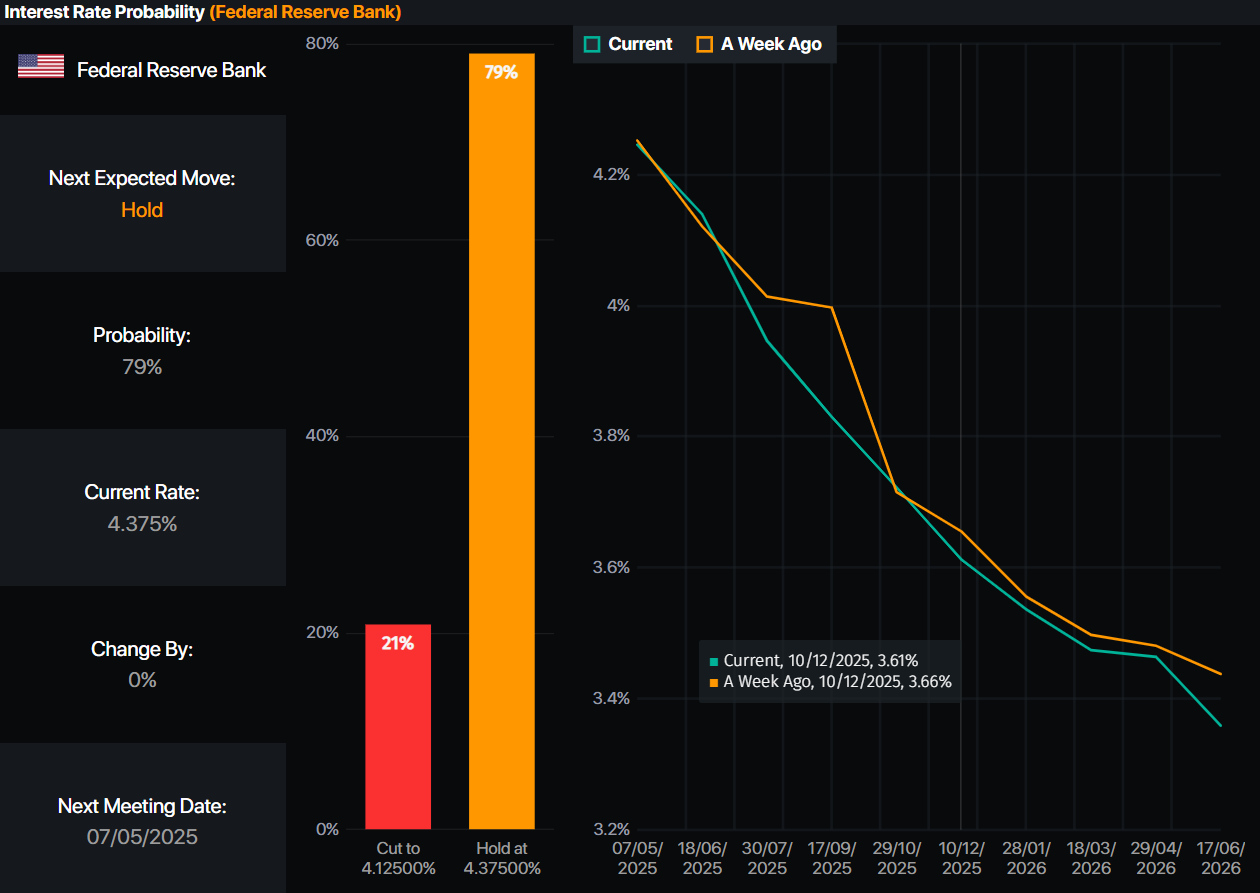

Meanwhile, money markets have priced in 73.5 basis points of Fed easing in 2025, jumping ten basis points from the previous day, according to Prime Market Terminal interest rate probabilities.

Source: Prime Market Terminal

Next week, the US economic docket will feature the April 2 Trump tariff announcement, the ISM Manufacturing PMI for March, JOLTS Job Openings and Nonfarm Payrolls.

Daily digest market movers: Gold prices set to challenge $3,100 in the short term

- The US 10-year T-note yield is plummeting, down ten basis points at 4.259%. US real yields edge down seven and a half bps to 1.887%, according to US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- The Personal Consumption Expenditures (PCE) Price Index held steady at 2.5% YoY in February, according to the US Bureau of Economic Analysis.

- Core PCE, which excludes food and energy, rose 2.8% YoY, up slightly from the upwardly revised 2.7% in the previous month. While largely maintaining the status quo, these readings indicate that inflation remains above the Fed’s 2% target.

- The University of Michigan’s Consumer Sentiment Index dipped from a preliminary 57.9 to 57.0, as US households grew more pessimistic.

- One-year inflation expectations climbed to 5%, while five-year expectations rose from 3.9% to 4.1%, reflecting rising consumer concerns over future price pressures.

XAU/USD technical outlook: Gold price rallies past $3,050, eyes on $3,100

Gold’s rally continues with the yellow metal poised to hit a record high of $3,086, clearing the path to challenge $3,100. Momentum suggests that Bullion prices seem poised to extend their gains, past the latter, with the psychological $3,150 and $3,200 exposed if cleared.

Due to the aggressiveness of the uptrend, the Relative Strength Index (RSI) turned overbought, exceeding 70. Nevertheless, the most extreme reading would be 80 as of the time of writing. Conversely, if the XAU/USD drops below March’s high of $3,057, this could exacerbate a pullback toward $3,000.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.